Native American Capital and LBCDE: A Double New Market Tax Credit Success

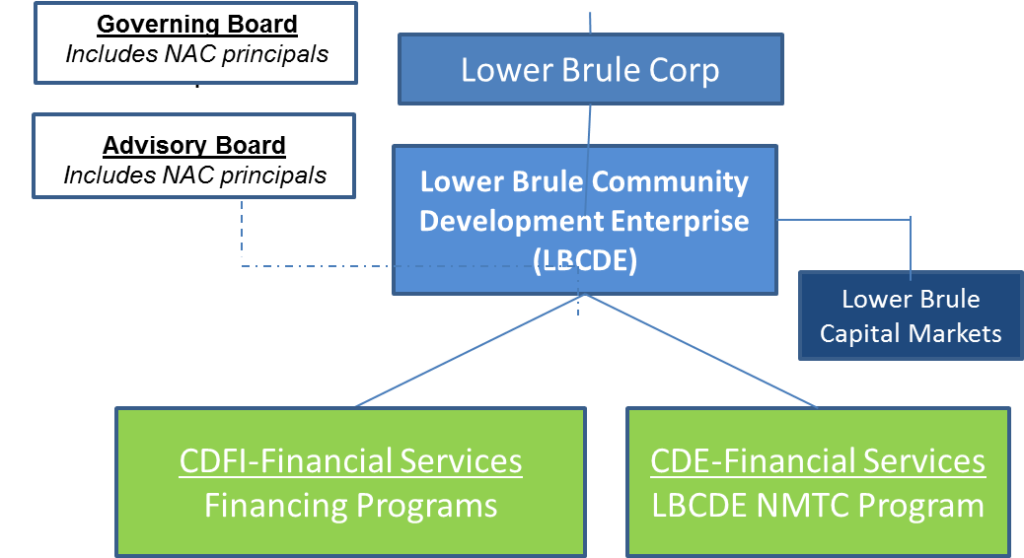

Lower Brule Sioux Tribe Financial Services Businesses

As Indian Country moves beyond grant funding to self-sustaining economic development, tribes must increasingly utilize a complex array of financing tools in a ‘tribal finance tool’ in order to achieve success. This paper describes the innovative application of one of those tribal finance tools—New Markets Tax Credits (NMTC) that is beginning to show significant, positive results in Indian Country

In February 2011, Native American Capital (NAC) helped Lower Brule Community Development Enterprise (LBCDE) to win an $18 million New Markets Tax Credit (NMTC) allocation. Deploying the NMTC allocation consistent with LBCDE core values involved careful collaboration among many stakeholders.

NAC spent the better part of 2011 developing and qualifying a pipeline of deals compatible with NMTC financing. Most tax credits support urban community development projects, not the type of rural projects that exist on Indian Reservations. In making the case for LBCDE’s NMTC application to the CDFI Fund at the US Department of the Treasury, NAC emphasized two key points that proved highly compatible with policymakers’ objectives:

- The huge backlog of NMTC-qualified rural projects located on Indian reservations

- The opportunity to implement innovative leveraging strategies on Indian Reservations with loan guarantees and tribal tax exempt bonds.

Upon completion of an extensive search campaign and professional diligence, LBCDE’s first NMTC transaction was a $9 million deal that brought the KemPosits manufacturing company to the Mississippi Choctaw on-reservation TechParc. The transaction closed on July 3, 2012. KemPosits manufactures walk-in bathtubs ideally suited to retirement homes and communities. KemPosits uses a topline, semirobotic process and brings intellectual property and training to the Choctaw community. This deal is on track to create 150 local jobs over the next few years.

An excellent example of how tribes can work together to further our common goal of building strong tribal economies.

Phyllis J. Anderson, Tribal Chief Choctaw

Building tribal economies necessitates the creation of strong linkages and networks that emphasize infrastructure development. With that in mind, working closely with NAC, LBCDE used the remaining $9 million allocation as part of the $52.5 million NMTC financing of the Terra-2 project, that closed on September 21, 2012. Alaska Growth Capital (the financing arm of the Arctic Slope Corporation), assembled the financing for Terra-2, the second phase of a massive project to create broadband internet infrastructure for the remote native villages on the Alaskan Slope northeast of Anchorage.

While LBCDE’s capital contribution was a small percentage of this development, the Terra-2 project is one of several broadband initiatives being undertaken by NAC. Lack of broadband and telecommunication infrastructure represents two of the greatest challenges to Indian country economic development and NAC is committed to and actively involved in reducing these barriers. For example, NAC is working with a team of experts and investors to identify and target broadband gaps across Indian Country, a goal supported by the National Telecommunications Information Agency (NTIA) in the Department of Commerce.

This article described the use of New Markets Tax Credits (NMTC) in Indian Country. NMTC is one element in Native American Capital’s (NAC’s) Tribal Finance Toolkit, a comprehensive array of financing tools and strategies uniquely available to Indian Country that can be drawn upon to maximize chances for a successful financing. By insisting that our clients undertake a rigorous financial feasibility analysis at a project’s inception, the likelihood of financing success is greatly enhanced.

If you or your tribe has a project that needs financing, please contact NAC so we can discuss with you how one or more of the tools in our service offerings could work for you.

Contact Us for more information.